UNIBA's Blog: The Latest on Parametric Insurance by Descartes Underwriting

20 February 2024

Welcome to UNIBA’s Blog – your go-to source for the latest insights into the world of insurance. In this edition, Neha Yadav, Business Development Director at Descartes Underwriting, discusses parametric insurance, a highly topical agenda item at our AsiaPac Regional Conference in Singapore, scheduled for 25-27 February. Read on to see why parametric can help in some of the most disaster-prone parts of the globe.

Home to almost one-third of the world’s annual tropical cyclones, Asia-Pacific represents one of the most active windstorm regions in the world. As climate change fuels Nat Cat volatility, the rising sum of insured losses due to cyclones/typhoons are putting increased pressure on the prices and capacities available for corporate insurance programs. This has resulted in more risk managers turning to alternative risk transfer solutions, including parametric insurance, to mitigate exposure and self-insured retentions.

Severity of events is much higher today than it was 20 years ago. We see this in recent events such as Cyclone Mocha, a severe storm that caused a $2.3 billion economic loss, or Typhoon Koinu, which was marked as the third strongest wind gust on record worldwide. The Philippines saw eight tropical cyclones, solely from May to December 2023. Overall, 2023 saw losses from nearly 400 natural disasters, of which many of the losses across APAC are still severely underinsured.

Next gen solutions against storm damage & Non-Damage Business Interruption (NDBI)

With the increase in frequency and severity, typhoon exposure is becoming increasingly challenging to insure, and to recover from. Material impacts due to such events prove costly both in terms of repairs/rebuilding and policy renewals, as recent losses tend to lead to premium hikes. In addition, typhoons often leave lasting direct and indirect impacts. These include loss of revenue, loss of attraction, denial of access or facilities interruption, emergency response or relocation costs, and an increase in the cost of labour and raw materials.

In light of the increasing Nat Cat protection gap, parametric insurance offers fresh capacity as an alternative risk transfer option to brokers, companies, and public entities looking to fill the gap left in their traditional program and mitigate against evolving cyclone/typhoon exposures.

How? Data revolution in an uncertain climate

Parametric solutions leverage near-real-time data of a typhoon's track and wind-speed, using modelling techniques and data sources that result in better risk assessment and overall insurance product design. The diffusion of technology throughout a parametric product not only more accurately captures a client’s exposure to future storms, it also enables near real-time monitoring of specific events. Coming from trusted third party providers, such as the Japan Meteorological Agency or NOAA, brokers and clients have unfiltered access to the parameters set in the parametric structure and certainty of what they will receive in light of a triggering typhoon event.

Through extensive use of data for pricing, parametric insurance radically simplifies the underwriting process, eliminating embedded costs and reducing the amount of time required to quote and bind a policy. Claims settlement parameters are agreed in advance which allows for rapid disbursement of cash to businesses and communities in the wake of extreme weather events.

How it works:

Unlike traditional insurance, which relies on lengthy loss-adjustment procedures, parametric insurance pays out when a predefined event (i.e. typhoon, earthquake etc.) occurs as measured by a specified parameter or index such as rainfall, wind-speed or peak ground acceleration. Driven by objective data and real-time monitoring from ground-based sensor technologies, radar, and satellite imagery, parametric insurance provides a means to guarantee liquidity via swift and direct pay-out following a qualifying event. This new generation of products complements or replaces traditional insurance at a more affordable premium that fits within contracting budgets. With no on-the-ground loss adjustment required, a parametric cover keeps costs low while offering precise protection.

Case study - Cat-in-a-Circle Structure: Filling Gaps in a Hospitality Client’s Traditional Program

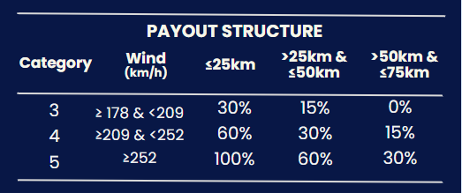

Alternative risk transfer insurance products leverage data to structure 'Cat-in-a-Circle' covers that provide a simple and transparent solution against typhoon risk. When a Cat-in-a-Circle policy is deployed, pay-outs are triggered when the typhoon of a given strength passes within a predefined distance from the insured location(s).

Problem: A large hospitality group was looking for a typhoon cover for a series of properties located in the Philippines. They were looking for an insurance structure with varying pay-out levels and scrambling for coverage, as their traditional carrier severely lowered their sub-limits for typhoons, while increasing rates following Typhoon Chanthu. The market capacity for windstorms also underwent a severe crunch.

Solution: Despite the market circumstances that often arise in the wake of catastrophic events, the robustness of parametric models ensure a consistent and reliable policy structure for brokers and clients. The client was able to secure a parametric solution, enabling them to close the deal with favourable terms for all parties. Given the straightforward simplicity of the cover, the policy was appropriately priced to match the client's budget and ensure a full-limit cover.

To learn more about Descartes’ parametric offering, please visit https://descartesunderwriting.com.